The reason a business plan matters is all about focus, and the ability to keep focus in proceeding towards your core objectives, and accountable to achieving them, even in a dynamic real-world environment full of distractions.Īs the famous military saying goes, “ no battle plan ever survives contact with the enemy”, because the outcomes of battle contact itself change the context, and it’s almost impossible to predict what exactly will come next. But not because you’re just trying to figure out what the basics of your business will be, which you may well have “figured out” in your head (or as the business grows, perhaps figured out in conversations with your partner).

Having been a part of the creation and growth of numerous businesses, I have to admit that my answer to “does a financial advisor really need a business plan?” is a resounding yes. Given that the overwhelming majority of financial advisors essentially operate as solo practitioners or small partnerships, this perhaps isn’t entirely surprising – when you can keep track of the entire business in your head in the first place, is there really much value to going through a formal process of crafting a financial advisor business plan?

Independent budget advisor how to#

There’s no end to the number of articles and even entire books that have been written about how to craft a business plan, yet in practice I find that remarkably few financial advisors have ever created any kind of formal (written or unwritten) business plan. Why A Business Plan Matters For Financial Advisors In 2010, Michael was recognized with one of the FPA’s “Heart of Financial Planning” awards for his dedication and work in advancing the profession. In addition, he is a co-founder of the XY Planning Network, AdvicePay, fpPathfinder, and New Planner Recruiting, the former Practitioner Editor of the Journal of Financial Planning, the host of the Financial Advisor Success podcast, and the publisher of the popular financial planning industry blog Nerd’s Eye View through his website, dedicated to advancing knowledge in financial planning. Michael Kitces is Head of Planning Strategy at Buckingham Strategic Wealth, which provides an evidence-based approach to private wealth management for near- and current retirees, and Buckingham Strategic Partners, a turnkey wealth management services provider supporting thousands of independent financial advisors through the scaling phase of growth. Doing so becomes an opportunity to not only to get feedback and constructive criticism about the goals, but in the process of articulating a clear plan for the business, the vetting process can also be a means to talk about the business and who it will serve, creating referral opportunities in the process!

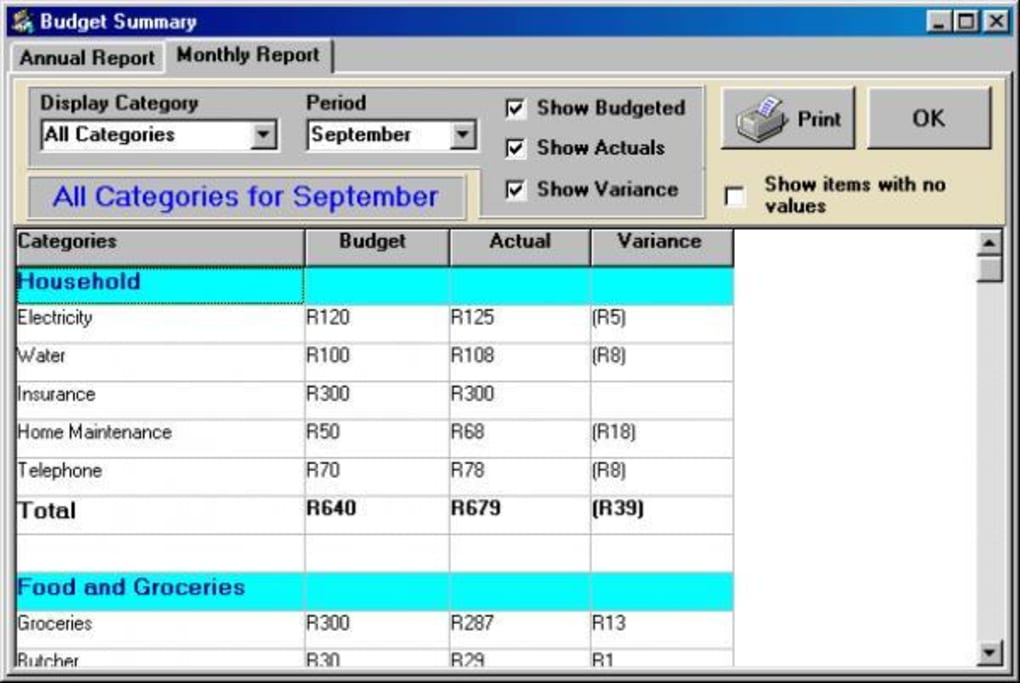

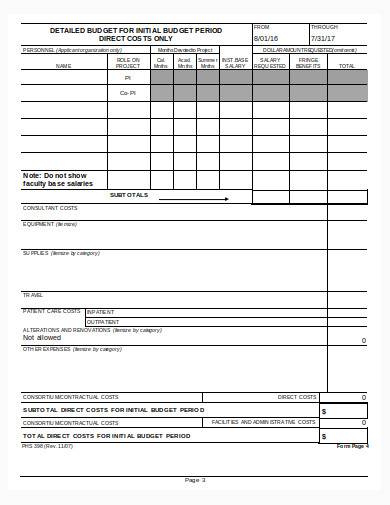

So what should the (one-page) financial advisor business plan actually cover? As the included sample template shows, there are six key areas to define for the business: who will it serve, what will you do for them, how will you reach them, how will you know if it’s working, where will you focus your time, and what must you do to strengthen (or build) the foundation to make it possible? Ideally, this should be accompanied by a second page to the business plan, which includes a budget or financial projection of the key revenue and expense areas of the business, to affirm that it is a financially viable plan (and what the financial goals really are!).Īnd in fact, because one of the virtues of a financial advisor business plan is the accountability it can create, advisors should not only craft the plan, but share it – with coaches and colleagues, and even with prospective or current clients. In fact, for many advisory firms, a simple “one-page” financial advisor business plan may be the best output of the business planning process – a single-page document with concrete goals to which the advisor can hold himself/herself accountable. Like financial planning, the process of thinking through the plan is still valuable, regardless of whether the final document at the end gets put to use. Yet the reality is that crafting a business plan is about more than just setting some business goals to pursue. For most advisors, they can “keep track” of the business in their head, making the process of creating a formal business plan on paper to seem unnecessary. In a world where most advisory firms are relatively small businesses, having a formal business plan is a remarkably rare occurrence.

0 kommentar(er)

0 kommentar(er)